UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registranto

| Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

| Middlesex Water Company |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| Middlesex Water Company

Iselin, New Jersey 08830

|

Dear Shareholder:

I am pleased

Thank you for your confidence in Middlesex Water Company. You are cordially invited to

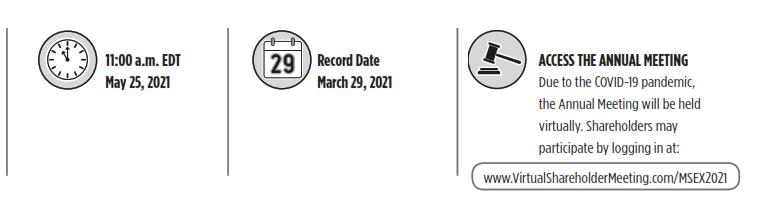

Thank you for your confidence in Middlesex Water Company. You are cordially invited to invite you to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Middlesex Water Company (the “Company”) towhich will be held at our offices at 1500 Ronson Road, Iselin, New Jersey 08830 on Tuesday, May 22, 201825, 2021 at 11:00 a.m. Eastern Daylight Time. The accompanying formal noticeEDT. This year’s meeting will be held virtually out of Annual Meeting and Proxy Statement set forth the details regarding admissioncontinued concerns related to the Annual Meeting, directionspandemic, and related shareholder health and safety.

At the business to be conducted.

The Proxy Statement contains four proposals recommended by our Board of Directors: 1) the election of two Directors, 2) a non-binding advisory vote to approve named executive officer compensation, 3) a proposal to approve the 2018 Restricted Stock Plan, and 4) the ratification of the Audit Committee’s appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for 2018, and to transact any other business that may be properly brought before the Annual Meeting. In addition to specific matters subject to your vote, management will report on Company activities. We welcome this opportunity to meet with our shareholders andmeeting, I look forward to sharing with you information about your commentsCompany’s performance during 2020.

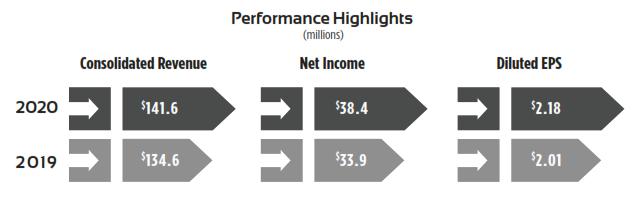

We continued to make investments in our facilities to enhance service reliability and questions.

Instructionsensure quality drinking water for votingpresent and future generations. We also took important additional steps to further build a more sustainable and diverse corporate culture. Performance highlights include:

We hope you will join us on May 25th as we further discuss our business and vote on issues of importance to your Company. Details for the meeting are foundincluded in this Proxy Statement and are contained on the proxy, or voting instruction card. ItAlso enclosed are details for how and when to vote and other important information. Your vote is very important, that your shares be represented and voted, regardless of the size of your holdings. Whether or notso please cast it promptly, even if you plan to attend the virtual Annual Meeting, I encourage you to vote your shares in advance of the meeting using any one of the convenient methods described.

Meeting.

On behalf of the Board I appreciateof Directors, thank you again for your continued intereststrong support and participationconfidence in the affairs of Middlesex

Water Company. I look forward to seeing you at the Annual Meeting.

Sincerely,

| |

Dennis W. Doll

Chairman, President and Chief Executive Officer

April 12, 2021

A Provider of Water, Wastewater and Related Products and Services

| Proxy Statement | TABLE OF CONTENTS |

CONSERVING NATURAL RESOURCES THROUGH INTERNET AVAILABILITY OF PROXY MATERIALS This year, we are again using the U.S. Securities and Exchange Commission’s Notice and Access model (“Notice and Access”) which allows delivery of proxy materials via the Internet as the primary means of furnishing proxy materials. We believe Notice and Access provides shareholders with a convenient method to access the proxy materials and vote, reduces the costs of printing and distributing proxy materials, and allows us to conserve natural resources in alignment with our role as an environmental steward. On or about April 12, 2021, we will mail a Notice of Internet Availability (“NOIA”) of Proxy Materials containing instructions on how to access our Proxy Statement and our 2020 Annual Report online and how to vote via the Internet. The NOIA also contains instructions on how to receive a paper copy of the proxy materials and our 2020 Annual Report to Shareholders. YOUR VOTE IS IMPORTANT We urge you to vote using telephone or internet voting, if available to you, or if you received these proxy materials by U.S. mail, by completing, signing, dating and returning the enclosed proxy card promptly. If voting by phone, please call the toll-free number found on your

Shareholders of record may deliver their completed proxy card in person at the Annual Meeting of Shareholders or by completing a ballot available upon request at the Annual Meeting. Please note that if you are a beneficial owner whose shares are held in the name of a bank, broker or other nominee, you must obtain a legal proxy, executed in your favor, from the shareholder of record (that is, your bank, broker or nominee) to be able to vote at the Annual Meeting. Beneficial owners of shares of |

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENTTO BE HELD ON MAY 25, 2021

TUESDAY, MAY 22, 2018 –25, 2021 — Annual Meeting of Shareholders

Middlesex Water Company

1500 Ronson Road

Iselin, New Jersey 08830Dear Shareholder:

Middlesex Water Company’sYou are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Middlesex Water Company (the “Company”) which will be held at the Company’s headquarters, 1500 Ronson Road, Iselin, New Jersey on Tuesday, May 22, 201825, 2021 at 11:00 a.m. (EasternEastern Daylight Time). Directions to our headquarters can be found onTime for the back cover of the Proxy Statement. At the meeting, shareholders will be asked to:following purposes:

Dennis W. Doll and Kim C. Hanemann

| Dennis W. Doll | Kim C. Hanemann | Ann L. Noble | Joshua Bershad, M.D. |

In addition, we will transact any other business properly presented at the meeting, including any adjournment or postponement by, or at, the direction of the Board of Directors.

This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully. You do not need to attend the Annual Meeting in order to vote. The Board of Directors (the “Board”)recommends that you vote in favor of each of the nominees for director (Proposal 1), and in favor of proposals 2 and 3.

Due to continued concerns related to the coronavirus outbreak (COVID-19), and to support the health and well-being or our shareholders, the Company will have a virtual only Annual Meeting of Shareholders in 2021, conducted exclusively via audiocast at www. virtualshareholdermeeting.com/MSEX2021. There will not be a physical location for our Annual Meeting and you will not be able to attend the meeting in person.

We strongly encourage all stockholders to vote, and to do so as promptly as possible. The deadline for voting by Internet or phone is 11:59 p.m. Eastern Daylight Time on Monday, May 24, 2021.

Middlesex Water Company • 485C Route 1 South • Suite 400 • Iselin, New Jersey 08830

1

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS Cont’d.

You are invited to attend the Annual Meeting via live audiocast. Whether or not you expect to virtually attend the Annual Meeting, please vote on the matters to be considered as promptly as possible in order to ensure your representation at the meeting. You may vote at www.virtualshareholdermeeting.com/MSEX2021 when you enter your 16-digit control number included with the Notice of Internet Availability or proxy card. Instructions on how to attend, participate in, and ask questions at, the Annual Meeting are posted at www.virtualshareholdermeeting.com/MSEX2021. You will be able to vote your shares while attending the Annual Meeting by following the instructions on the website.

The Board has fixed the close of business on March 26, 201829, 2021 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record as of the close of business on March 29, 2021, or their proxy holders, may vote at the Annual Meeting. Please note that in the absence of specific instructions as to how to vote, brokers may not vote your shares on the election of Directors or the non-binding proposal regarding the compensation of our Named Executive Officers and the non-binding proposal regarding the 2018 Restricted Stock Plan. Please return your proxy card so your vote can be counted.Officers.

This year, we are again using the U.S. Securities and Exchange Commission’s Notice and Access model (“Notice and Access”) which allows delivery of proxy materials via the Internet as the primary means of furnishing proxy materials. We believe Notice and Access provides shareholders with a convenient method to access the proxy materials and vote, reduces the costs of printing and distributing proxy materials, and allows us to conserve natural resources in alignment with our role as an environmental steward. On or about April 12, 2018, we will mail a Notice of Internet Availability of Proxy Materials (“NOIA”) containing instructions on how to access our Proxy Statement and our 2017 Annual Report online and how to vote via the Internet. The NOIA also contains instructions on how to receive a paper copy of the proxy materials and our 2017 Annual Report to shareholders.

By Order of the Board of Directors, | |

Iselin, New Jersey |  |

April 12, | |

Jay L. Kooper | |

Vice President, General Counsel and Secretary |

Middlesex Water Company 1 2018

IMPORTANT NOTICE REGARDING OF PROXY MATERIALS This Proxy Statement and our 2020 Annual Report on Form 10-K will be available to stockholders at http://www.proxyvote.com on or about April 12, 2021. |

2

PROXY STATEMENT

This summary highlights information contained in further detail elsewhere in this Proxy Statement. It does not contain all of the information you should consider. Youconsider and you should read the entire Proxy Statement prior toproxy statement carefully before voting. Our Proxy Statement and other proxy materials are first being made available to our shareholdersFor more complete information regarding the Company’s 2020 performance, please also review the Company’s Annual Report on or about April 12, 2018.

Form 10-K for the year ended December 31, 2020.

Location: Exchange: Nasdaq Record Date: March

Mail Date: April 12, 2021 Year of Incorporation: 1897 Transfer Agent: Broadridge Financial Services, Inc. |

Shareholder Service Website: | |

The |

| PROPOSAL | BOARD VOTE RECOMMENDATION | PAGE REFERENCE | ||

1. Election of Directors | FOR EACH DIRECTOR NOMINEE | 6 | ||

| DIRECTOR NOMINEES | ||||

| Name | Age | Director Since | Class | Independent |

| Joshua Bershad, M.D. | 47 | 2020 | III | YES |

| Dennis W. Doll | 62 | 2006 | I | NO |

| Kim C. Hanemann | 57 | 2016 | I | YES |

| Ann L. Noble | 59 | 2019 | I | YES |

Director Attendance at 2017 Annual Meeting: 100%

Board Meetings in 2017: 12

Director Attendance at 2017 Board Meetings: 91%

Standing Board Committees (Meetings in 2017): 18

Audit Committee (7)

Compensation Committee (3)

Corporate Governance Committee (4)

Pension (4)

Ad Hoc Pricing Committee (0)

Corporate Governance Materials:

www.MiddlesexWater.com

Board Communication:

Middlesex Water Company

Attn.: Corporate Secretary

1500 Ronson Road

Iselin, New Jersey 08830

| ||||

|

| |||

| MANAGEMENT PROPOSALS | ||||

| 2. Advisory Vote to Approve the Company’s Named Executive Officer Compensation | FOR | 32 | ||

| 3. Ratification of Baker Tilly US, LLP as Independent Auditor for 2021 | FOR | 34 | ||

Middlesex Water Company 2 20183 2021 Proxy Statement

| 1. | What is the purpose of the Annual Meeting? |

At the Annual Meeting, shareholders will consider and vote upon fourthree proposals:

Shareholders may also vote upon such other matters as may properly come before the Annual Meeting or any adjournment thereof.

| 2. | Why am I receiving these proxy materials? |

We are furnishing you these proxy materials in connection with the solicitation of proxies on behalf of our Board for use at the Annual Meeting. This Proxy Statement includes information we are required to provide under U.S. Securities and Exchange Commission (“SEC”) rules and is designed to assist you in voting your shares.

| 3. | How can I get electronic access to the proxy materials? |

The Notice of Internet Availability (“NOIA”) of Proxy Materials will provide you with instructions how to 1) view on the Internet our proxy materials for the Annual Meeting; and 2) instruct us to send proxy materials to you by U.S. mail. The proxy materials are available atwww.proxyvote.com.

| 4. | What is a proxy? |

A proxy is your legal designation of another person to vote the shares you own. If you designate someone as your proxy or proxy holder in a written document, that document is called a proxy or a proxy card. Steven M. Klein

Directors James F. Cosgrove, Jr. and Amy B. MansueWalter G. Reinhard have been designated as proxies or proxy holders for the Annual Meeting. Proxies properly executed and received by our Corporate Secretary prior to the Annual Meeting, and not revoked, will be voted in accordance with the terms thereof.

| 5. | How are other proxy materials being furnished? |

Under rules adopted by the SEC, we have chosen to furnish our proxy materials to our shareholders over the Internet and to provide a NOIA of proxy materialsProxy Materials by U.S. mail, rather than mailing the printed proxy materials. As a result, the Company is able to reduce printing and postage costs, as well as minimize adverse impact on the environment. If you receive a NOIA, you will not receive a printed copy of the proxy materials in the mail unless you request them by following the instructions provided in the NOIA. Instead, the NOIA instructs you how to access and review all of the information contained in the Proxy Statement and Annual Report to Shareholders.Shareholders online. The NOIA also explains how you may submit your proxy over the Internet. If you would like to receive a printed copy of our proxy materials, you should follow the instructions in the NOIA.

| 6. | Who is entitled to vote at the Annual Meeting? |

Shareholders of record at the close of business on March 26, 2018,29, 2021, which we refer to as the Record Date, (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, we had 16,357,764there were 17,478,098 shares of Middlesex Water Company (“Common Stock”) issued and outstanding, each entitled to one vote. A complete list of shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder of record at our offices at 1500 Ronson Road,485C Route 1 South, Suite 400, Iselin, NJ 08830 for a period of 10 days prior to the Annual Meeting. The list will also be available for examination by any shareholder of record at the Annual Meeting.

| 7. | What is the difference between holding shares as a shareholder of record and as a beneficial owner holding shares in “street name”? |

You are a “Shareholder of Record” if, at the close of business on the Record Date, your shares were registered directly in your name with Broadridge Corporate Issuer Solutions, Inc. (“Broadridge”), our transfer agent. You are a beneficial owner if, at the close of business on the Record Date, your shares were held by a brokerage firm or other nominee and not directly in your name. Being a beneficial owner means that, like most of our shareholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares by following the voting instructions your broker or nominee provides.

| 8. | How will my shares be voted if I do not vote or if I have not provided instructions to my broker? |

All shares that have been properly voted, whether by Internet, telephone or U.S. mail, and not revoked, will be voted at the Annual Meeting in accordance with your instructions. If you are a shareholder of record and you do not vote by proxy card, by telephone, via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting. If you sign your proxy card but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board.

If any other matters are properly presented at the Annual Meeting for consideration and if you have voted your shares by Internet, telephone or U.S. mail, the persons named as proxies in the proxy card will have the discretion to vote on those registered matters for you.

If you are the beneficial owner and you do not direct your broker or nominee how to vote your shares, your broker or nominee may vote your shares on only those proposals for which it has discretion to vote.

Please note that under the rules of the Nasdaq Global Select Stock Market (“Nasdaq”) your bank, broker or other nominee may not vote your shares with respect to matters considered non-routine (Proposals 1,21 and 3)2). Proposal 4,3, the ratification of our auditor is a routine matter on which brokers and nominees can vote on behalf of their clients if clients do not furnish voting instructions.

| 9. | How many votes must be present to hold the Meeting? |

In order for the Annual Meeting to be conducted, a majority of the outstanding shares of Common Stockcommon stock as of the record date must be present in person or represented by proxy at the Annual Meeting. This is referred to as a quorum.

Middlesex Water Company 3 20184 2021 Proxy Statement

| 10. | What is the vote required for each proposal and what are my voting |

Proposal | Vote Required | Broker Discretionary Vote Allowed |

| Proposal 1 - Election of | Plurality of votes cast | No |

| Proposal 2 - Advisory vote on executive compensation | Majority of the shares entitled to vote and present or represented by proxy | No |

Proposal 3 - Ratification of auditors for 2021 | Majority of the shares entitled to | |

|

|

With respect to Proposal 1, the election of four Directors, you may vote FOR ALL, WITHHOLD ALL or FOR ALL EXCEPT and indicate any nominee for which you withhold authority to vote. Directors are elected by a plurality of votes cast by shareholders present in person or represented by proxy at the Annual Meeting, and entitled to vote on the election of Directors. With respect to Proposals 2 3 and 4,3, (or any other matter to be voted at the Annual Meeting), you may vote FOR, AGAINST or ABSTAIN. The approval of the non- bindingnon-binding advisory vote regarding the compensation of our Named Executive Officers (Proposal 2) and the vote to approve the 2018 Restricted Stock Plan (Proposal 3) requires that the votes cast in favor of the proposal exceed the number of votes cast against the proposal. The ratification of the appointment by the Audit Committee of Baker Tilly Virchow Krause,US, LLP (Proposal 4)3) requires that the votes cast in favor of the ratification exceed the number of votes opposing the ratification.

| 11. | How does the Board recommend I vote? |

The Board of Directors recommends that you vote:

| 12. | How are abstentions and broker non-votes counted? |

For purposes of determining the votes cast with respect to any matter presented for consideration at the Annual Meeting, only those votes cast “for” or “against” are included. As described above, where brokers do not have discretion to vote or did not exercise such discretion, the inability or failure to vote is referred to as a “broker non-vote.” Proxies marked as abstaining, and any proxies returned by brokers as “non-votes” on behalf of shares heldheld in street name because beneficial owners’ discretion has been withheld as to one or more matters to be acted upon at the Annual Meeting, will be treated as present for purposes of determining whether a quorum is present at the Annual Meeting. Broker non-votes and withheld votes will not be included in the vote total for the proposal to elect the nominees for Director and will not affect the outcome of the vote for these proposals. In addition, under New Jersey corporation law, abstentions are not counted as votes cast on a proposal. Therefore, abstentions and broker non-votes will not count either in favor of or against the nonbinding advisory proposal regarding the approval of the compensation of our named executive officers, the vote onthe 2018 Restricted Stock Planexecutives or the ratification of the appointment of Baker Tilly Virchow Krause,US, LLP.

| 13. | May I revoke my proxy or change my vote? |

Yes. You may revoke a proxy you have given at any time before it is voted at the Annual Meeting by: (1) submitting to our Corporate Secretary a letter revoking the proxy, which the Secretary must receive prior to the Annual Meeting, or (2) attendingvoting at the virtual Annual Meeting and voting in person.Meeting. Attendance at the Annual Meeting will not by itself revoke a previously granted proxy, unless you specifically request it. You may change your proxy instructions for shares in “street name” by submitting new voting instructions to your broker or nominee.

| 14. | Who will count the vote? |

Votes will be counted by representatives of Broadridge Corporate Issuer Solutions, Inc. who will tally the votes and certify the results.

| 15. | Who can attend the Annual Meeting? |

All shareholdersShareholders of recordRecord as of the close of business on March 26, 201829, 2021 can attend the Annual Meeting. Seating, however, is limited. AttendanceMeeting via webcast at the Annual Meeting will be on a first arrival basis. Shareholders are not permitted to bring cameras or recording devices to the Annual Meeting.www.virtualshareholdermeeting.com/ MSEX2021.

Middlesex Water Company 4 2018 Proxy Statement

| 16. | Will there be a management presentation at the Annual Meeting? |

Management will give a brief presentation during the meeting and shareholders will be invited to ask questions.submit questions online.

| 17. | When are shareholder proposals due for the |

To be considered for inclusion in our Proxy Statement mailedto be issued in 2019, stockholder2022, shareholder proposals must be received at our executive offices on or before December 10, 2018. Stockholder14, 2021. Shareholder proposals should be directed to the Corporate Secretary at Middlesex Water Company, 1500 Ronson Road, P.O. Box 1500,485C Route 1 South, Suite 400, Iselin, New Jersey 08830-0452,08830-0452.

| 18. | Where can I find the voting results of the Annual |

We will announce preliminary results at the Annual Meeting. We will issue final results in a press release and in a current report on Form 8-K thatwhich we will file with the SEC on or about May 23, 2018.26, 2021.

| 19. | How can I participate in Householding of Annual Meeting |

The SEC rules permit us, with your permission, to deliver a single paper Proxy Statement and annual reportAnnual Report to any household at which two or more share- holdersshareholders of record reside at the same address. Each shareholder will continue to receive a separate proxy card. This procedure, known as “householding”“house-holding” reduces the volume of duplicate information you received and reduces our expenses.expenses and environmental impact. Once given, a shareholder’s consent will remain in effect unless and until he or she revokes it is revoked by notifying our Corporate Secretary as described above. If you revoke your consent, we will begin sending you individual copies of future mailings of these documents within 30 days after we receive your revocation notice. Shareholders of record who elect to participate in householding may also request a separate copy of future Proxy Statements and annual reportsAnnual Reports by contacting our Corporate Secretary in writing at Office of the Corporate Secretary, Middlesex Water Company, 1500 Ronson Road, P.O. Box 1500,485C Route 1 South, Suite 400, Iselin, New Jersey 08830-0452.

Separate Copies for Beneficial Owners

Institutions that hold shares in street name for two or more beneficial owners with the same address are permitted to deliver a single Proxy Statement and Annual Report to that address. Any such beneficial owner can request a separate paper copy of this Proxy Statement or the Annual Report on Form 10-K by contacting our Corporate Secretary as described above. Beneficial owners with the same address who receive more than one paper Proxy Statement and Annual Report on Form 10-K may request delivery of a single Proxy Statement and Annual Report on Form 10-K by contacting our Corporate Secretary as described above.

Middlesex Water Company 5 20182021 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

The Board is elected by shareholders to oversee their interest in the overall success of our business. Board members are divided into three classes with staggered three-year terms of office.terms. The Corporate Governance & Nominating Committee periodically reviews the efficacy of declassifying the Board. This matter was last presentedThe Board continues to the full Board for evaluation in February 2018. Upon thorough discussion, the Board concludedmaintain that maintaining its present classification structure with three classes of Directors with as nearly equal number of members as practicable, provides for the most effective continuance of the knowledge and experience gained by members of the Board, and that maintaining the current Board classification structure serves the best interests of shareholders.

Election of Directors (Proposal No. 1)

Middlesex Water Company has eight Directors on its Board. The following Table provides summary information about each Director nominee standing for re-election to the Board. Additional information for all of our Directors, including the nominees, may be found beginning on page 7.

| Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships | Experience and Skills |

| Dennis W. Doll | 59 | 2006 | Chairman, President and | No | Executive and Industry Leadership, Regulated and Non-regulated Utility Management, Contract Operations, Capital Management | |

| Kim C. Hanneman | 54 | 2017 | Senior Vice President- Delivery | Yes | Audit Committee, Pension Committee | Executive and Industry Leadership, Project and Construction Management, Field and Utility Support Operations, Permitting, Asset Management |

Middlesex Water Company 6 2018 Proxy Statement

NOMINEES FOR THE BOARD OF DIRECTORS

The present terms of Class I Directors expiresexpire at the 20182021 Annual Meeting of Shareholders. Upon the recommendation of the Corporate Governance and Nominating Committee, the Board has nominated for election two Directors. John R. Middleton,named a new director, Joshua Bershad, M.D., a Class I Director, will not be standing for reelection to the Board of Directors.in December 2020 as a Class III Director. Dr. Bershad and the three Class I nominees will stand for election at the Annual Meeting. The Director nominees for election named below are willing to be duly elected and to serve. Directors shall be elected by a plurality of the votes cast at the Annual Meeting. If at the time of the election any of the nominees listed should be unable to serve, it is the intention of the persons designated as proxies to vote, in their discretion, for other nominees, unless the number of Directors is reduced. There were no nominee recommendations from shareholders or from any group of shareholders submitted in accordance with regulations of the Securities and Exchange Commission.SEC.

Election of Directors (Proposal No. 1)

Middlesex Water Company has eight Directors on its Board. The following Table provides summary information about each Director nominee standing for initial election or re-election to the Board. Additional information for all of our Directors, including the nominees, may be found beginning on page 7.

| Name | Age | Director Since | Principal Occupation | Independent | Committee Memberships | Experience and Skills |

| Joshua Bershad, M.D. | 47 | 2020 | Executive Vice President of Physician Services at RWJBarnabas Health and Chief Medical Officer of Rutgers Athletics | Yes | Audit | Executive Leadership, Internal Medicine, Public Health and Safety, Administration |

| Dennis W. Doll | 62 | 2006 | Chairman, President & CEO of Middlesex Water Company | No | — | Executive and Industry Leadership, Regulated and Non-regulated Utility Management, Contract Operations, Capital Management |

| Kim C. Hanemann | 57 | 2016 | Senior Vice President and Chief Operating Officer of Public Service Electric and Gas Company (PSE&G) | Yes | Audit, Corporate Governance & Nominating | Executive and Industry Leadership, Project and Construction Management, Field and Utility Support Operations, Permitting, Asset Management |

| Ann L. Noble | 59 | 2019 | Financial Consultant | Yes | Corporate Governance & Nominating, Pension, Ad Hoc Pricing | Strategic Planning, Business Development, Financial Management, Contract Negotiation |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS SHAREHOLDERS VOTE FOR THE ELECTION OF THE FOUR DIRECTOR NOMINEES NAMED ON PAGE 7-8. |

Middlesex Water Company 6 2021 Proxy Statement

NOMINEES FOR THE BOARD OF DIRECTORS

We set forth information with respect to the business experience, qualifications and affiliations of our directorDirector nominees below:

Class I – (Term expires in 2018)2021)

Dennis W. Doll

Dennis W. Doll

Director since 2006

Age: 5962

Term: Three(3)Three (3) years

Experience and Qualifications:

The Board has concluded that Mr. Doll is qualified to serve onserves as Chairman of the Board, becausePresident and CEO of his executive and industry leadership,Middlesex Water Company.

Mr. Doll has more than 35 years of experience in regulatedsenior level positions in investor-owned water and non regulatedwastewater utility management, contract operations and capital management. Mr. DollHe joined the Company in 2004Middlesex Water as Executive Vice President in November 2004 and was named President and Chief Executive Officer, and a Director of Middlesex, effective January 1, 2006. In May 2010, he was elected Chairman of the Board. He isBoard also serving as Chairman for all subsidiaries of Middlesex. Prior to joining the Company,Boards of Middlesex Water Company’s subsidiary companies. Mr. Doll had been employed in various executive leadership roles in the regulatedspeaks frequently on water related issues including asset & capital management, infrastructure policy, utility business since 1985. Mr. Doll also servespreparedness and resiliency. He has served as a volunteer Director on selected non-profit utility industry-related Boards including the New Jersey Utilities Association (Past Chairman), The Water Research Foundation (presently Co-Vice Chairman),Past President of the National Association of Water Companies (Past President) and past Chairman of the New Jersey Utilities Association, representing New Jersey’s electric, gas, water and telecommunications industries.

Mr. Doll recently completed services as Chairman of the Board of The Water Research Foundation and as a Director and member of the Executive Committee of the Board of the American Water Works Association. He presently serves as Treasurer and member of the Board of Court Appointed Special Advocates (CASA) of Middlesex County. County, NJ.

Education:

Mr. Doll further serves asreceived a Director of Hammer Fiber Optics Holdings Corp. (OTCQB: HMMR); an alternative telecommunications carrier providing high capacity broadband service through a wireless access network.B.A. Degree in Accounting and Economics from Upsala College.

Class I – (Term expires in 2018)2021)

Kim C.

Kim C. HannemanHanemann

Independent Director since 2016

Board Committees:

Audit

Pension | Corporate Governance & Nominating

Age: 5457

TermTerm: Three (3) years

The Board has concluded that Ms. Hanemann is qualified to serve on the Board because of her executive leadership, experience in projectExperience and construction management, leadership in resiliency initiatives, licensing and permitting. Qualifications:

Ms. Hanemann is Senior Vice President – Delivery Projects and ConstructionChief Operating Officer of Public Service Electric and Gas Company (PSE&G), New Jersey’s oldest and largest public utility company, where she is responsible for execution of the company’s large transmission construction projects. Her responsibilities include oversight of project management, project controls, licensing and permitting, and commissioning. This large portfolio of services under Ms. Hanemann’s management also includes management of key components of PSE&G’s resiliency initiatives and asset hardening projects on company facilities. Although larger in scope and cost, these utility infrastructure challenges are analogous to those managed by Middlesex Water Company. Ms. Hanemann has held numerous leadership positions in both electric and gas field operations and in utility support operations. She was named Vice President in 2010, and Senior Vice President in 2014. Ms. Hanemann serves as a director of the Foundation Board of Children’s Specialized Hospital. She is also the Executive Sponsor for PSEG Women’s Network, an employee resource group aimed at providing women with career development insights and serves on PSEG’s Diversity and Inclusion Council. insights.

Education:

Ms. Hanemann earned her Bachelor’s degree in mechanical engineering from Lehigh University and an M.B.A. from Rutgers Graduate School of Management.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE TWO DIRECTOR NOMINEES NAMED ABOVE.

Middlesex Water Company 7 20182021 Proxy Statement

NOMINEES FOR THE BOARD OF DIRECTORS

Class I (Term Expires in 2021)

Ann L. Noble

Ann L. Noble

Independent Director since 2019

Board Committees:

Ad Hoc Pricing

Corporate Governance & Nominating

Pension

Age: 59

Term: Three (3) years

Experience and Qualifications:

Ms. Noble serves as a Financial Consultant providing advisory services in the areas of strategic planning, financial management and contract negotiation. She previously worked for Qual-Lynx for 14 years holding various positions including President and Chief Executive Officer the last 5 years of her tenure. Prior to that, Ms. Noble served as Vice President, Workers’ Compensation for QualCare, Inc. and Vice President of Finance for Robert Wood Johnson University Hospital. Ms. Noble’s background includes financial and contract management, sales and strategic planning. Ms. Noble serves on the Board of Manasquan Bank and is a Member of the Board of Trustees and Treasurer of the Val Skinner Foundation.

Education:

Ms. Noble earned a B.S. in Accounting from Seton Hall University and is a Certified Public Accountant (inactive).

Class III (Term Expires in 2023)

Joshua Bershad, M.D.

Joshua Bershad, M.D.

Independent Director since 2020

Board Committees:

Audit

Age: 47

Term: Two (2) years

Experience and Qualifications:

Dr. Bershad is Executive Vice President, Physician Services of RWJBarnabas Health and Chief Medical Officer of Rutgers Athletics. In addition to his role with RWJBarnabas Health and Rutgers Athletics, Dr. Bershad teaches in multiple capacities at Rutgers University, including as Clinical Assistant Professor of Medicine at Rutgers-Robert Wood Johnson Medical School, as Adjunct Clinical Professor at Rutgers-Ernest Mario School of Pharmacy, and as Visiting Lecturer at Rutgers Business School EMBA Program. Previously, he served in multiple senior executive roles within Robert Wood Johnson University Hospital & Health System, including Senior Vice President/Chief Medical Officer and Chair of the Medical Executive Committee for approximately 10 years. He was the organizer and initial President of RWJ Physician Enterprise, a multispecialty physician group. Dr. Bershad serves as a member of the Board of Directors of the Middlesex County Medical Society and is Chairman of the Board of Directors of Robert Wood Johnson Visiting Nurses. He also is a member of the Board of Trustees of the VNA Health Group.

Education:

Dr. Bershad attended both Rutgers Medical School and Rutgers Business School where he received his MD and MBA, respectively. He also holds a Bachelor’s degree in Biology/Geology from the State University of New York (SUNY) Binghamton.

Middlesex Water Company 8 2021 Proxy Statement

DIRECTORS WITH UNEXPIRED TERMS

We set forth information with respect to the business experience, qualifications and affiliations of our Directors with unexpired terms below:

Class II – (Term expires in 2019)2022)

Steven M. Klein

Steven M. Klein

Independent Director since 2009

Board Committees:

Audit, Chair

| Audit Committee Financial Expert |

Compensation

| Pension

Age: 5255

Experience and Qualifications:

Mr. Klein serves as President and and CEO of Northfield Bancorp, Inc. and its subsidiary, Northfield Bank, with overall management responsibility for activities of these entities. Mr. Klein is also designated as a financial expert on the Audit Commit- tee.Committee. Mr. Klein was named to the Board of Directors of Northfield Bancorp Inc. and Northfield Bank in August 2013. Mr. Klein’s background includes serving as an audit partner with the international accounting and auditing firm KPMG LLP. He is a Certified Public Accountant in the State of New Jersey and member of the American Institute of Certified Public Accountants and the New Jersey Society of Certified Public Accountants. He is a board member of the New Jersey Bankers Association and the American Bankers Association. Mr. Klein serves on the Board of Trustees of Richmond University Medical Center. He

Education:

Mr. Klein earned a B.A. in Business Administration from Montclair State University.

2019)

Amy B. Mansue

Independent Director since 2010

Board Committees:

Audit

Compensation, Chair

Corporate Governance & Nominating

Age: 53

Ms. Mansue is President of Southern Region RWJ Barnabas Health. She formerly served as President and Chief Executive officer of Children’s Specialized Hospital for 13 years. Ms. Mansue’s background includes serving as a staff member on healthcare policy for former New Jersey Governor Jim Florio; serving as a Deputy Commissioner in the New Jersey Department of Human Services and as Deputy Chief of Staff to former New Jersey Governor James McGreevey. She was President of HIP/NJ and Senior VP of Strategy for HIP/NY. Ms. Mansue serves on the Boards of the New Jersey Chamber of Commerce, the New Brunswick Development Corporation and the New Jersey Hospital Association, where she serves as Chair. Ms. Mansue holds a Bachelor’s degree in social welfare and a Master’s degree in social work, planning and management from the University of Alabama.

Class II – (Term expires in 2019)2022)

Walter G. Reinhard, Esq.

Walter G. Reinhard, Esq.

Independent Director since 2002

Committees:

Lead Director | Ad Hoc Pricing, ex officio |

Corporate Governance & Nominating, Chair |

Pension

Age: 7275

Experience and Qualifications:

Mr. Reinhard was named Lead Director in May 2020. He served as a partner of the law firm of Norris McLaughlin, & Marcus, P.A. prior to his retirement from the active practice of law and partnership in the firm on December 31, 2014. Mr. Reinhard had been with the firm since 1984 and practiced administrative, environmental and regulatory law involving public utilities. He brings over 40 years of legal experience to the Board including expertise in handling regulatory matters before the New Jersey Board of Public Utilities and the New Jersey Department of Environmental Protection. During his tenure at Norris McLaughlin, & Marcus, Mr. Reinhard’s professional affiliations included the New Jersey State Bar Association and its Public Utility Law SectionLawSection (Chair, 1988-89), the Water Utility Council of the American Water Works Association, New Jersey Chapter, and the New Jersey Chapter of the National Association of Water Companies. Mr. Reinhard serves as a Trustee of the Fanwood- ScotchFanwood-Scotch Plains YMCA. He

Education:

Mr. Reinhard received his B.A. from the University of Pennsylvania and his J.D. from Pennsylvania State University’s Dickinson School of Law.

Middlesex Water Company 8 2018 Proxy Statement

DIRECTORS WITH UNEXPIRED TERMS

Class IIIII – (Term expires in 2020)2022)

James F. Cosgrove Jr., P.E.

James F. Cosgrove Jr., P.E. Amy B. Mansue

Amy B. Mansue

Independent Director since 2010

Board Committees:

Corporate Governance & NominatingAudit | Compensation, Chair

Pension, Chair

Age: 56

Experience and Qualifications:

Ms. Mansue is President and Chief Executive Officer of Inspira Health, comprising three hospitals, a comprehensive cancer center and several multi-specialty health centers. Her most recent former roles include serving as: Executive Vice President and Chief Experience Officer of RWJBarnabas Health, RWJBarnabas Health – President of the Southern Region, and President and Chief Executive Officer of Children’s Specialized Hospital. Ms.Mansue’s background includes serving as a staff member on healthcare policy for former New Jersey Governor Jim Florio, serving as a Deputy Commissioner in the New Jersey Department of Human Services and as Deputy Chief of Staff to former New Jersey Governor James McGreevey. She was President of HIP/NJ and Senior VP of Strategy for HIP/NY. Ms. Mansue serves on the Boards of the New Jersey Chamber of Commerce and the New Brunswick Development Corporation.

Education:

Ms. Mansue holds a Bachelor’s degree in social welfare and a Master’s degree in social work, planning and management from the University of Alabama.

Class III – (Term expires in 2023)

James F. Cosgrove Jr., P.E.

James F. Cosgrove Jr., P.E.

Independent Director since 2010

Board Committees:

Ad Hoc Pricing, Chair | Compensation |

Corporate Governance & Nominating |

Pension, Chair

Age: 5457

Experience and Qualifications:

Mr. Cosgrove is Vice President and Principal of Kleinfelder, a firm offering consulting in architecture, civil and structural engineering, construction management, environmental analysis, remediation, and natural resources management throughout the U.S., Canada and Australia. A Professional Engineer licensed in the State of New Jersey, Mr. Cosgrove has over 2530 years experience in the field of environmental engineering and science with extensive background in water quality monitoring and modeling. Prior to his current position, Mr. Cosgrove was Principal and Founder of Omni Environmental LLC, an environmental consulting firm based in Princeton, New Jersey. Mr. Cosgrove’s professional affiliations include the American Society of Civil Engineers, the American Water Resources Association, the National Society of Professional Engineers, and the Water Environment Federation, among others. He served as a director of the Association of Environmental Authorities from 2005-2011 and currently serves as Chairperson of the New Jersey Clean Water Council.

Education:

Mr. Cosgrove received a B.S. degree in Civil Engineering from Lafayette College and earned his M.E. in Environmental and Water Resource Systems Engineering from Cornell University.

Middlesex Water Company 9 2021 Proxy Statement

Class III – (Term expires in 2020)Table of Contents

DIRECTOR COMPENSATION AND EQUITY OWNERSHIP GUIDELINES

Jeffries Shein

Jeffries Shein

Independent Director since 1990Compensation

Board Committees:

Compensation

Corporate Governance & Nominating

Ad Hoc Pricing

Age: 77

Mr. Shein is managing partner of JGT ManagementFor 2020, Middlesex Water Company LLC, a management and investment firm since 2003. He was formerly a Partner of Jacobsen, Goldfarb and Tanzman Associates, onecompensated each of the largest industrial and commercial real estate brokerage firms in New Jersey.Board members who are not employed by the Company (“Outside Directors”) with Common Stock valued at $35,000. Mr. Shein retired fromDoll, Chairman of the Board and an Executive Officer of Directors of publicly-traded Provident Bank in April 2015 and was a director of its predecessor, First Savings Bank. Mr. Shein has served on boards and committees of numerous community, non-profit and professional organizations. Mr. Shein isthe Company, receives no fee or common stock award for his services as a member of the SocietyBoard or the Boards of Officethe Company’s subsidiaries. The table below sets forth the annual retainers for 2020.

| Position | Annual Retainer |

| Outside Director | $50,000 (1) |

| Lead Director | $ 5,000 |

| Chair of Audit Committee | $ 7,500 |

| Chair of Compensation Committee | $ 5,000 |

| All other Chairpersons | $ 2,500 |

| (1) | The annual retainer of $50,000 consists of a cash compensation component of $15,000 and a common stock compensation component of $35,000. |

The Board committee meeting fees for outside Directors is $750 per Director for each Board committee meeting attended. In the event that a Special Board or a Special Committee meeting via teleconference were to be held, the meeting fees for outside Directors are $400 and Industrial Realtors. He received$200 per meeting, respectively.

The following table details Director compensation for 2020.

Name | Fees earned or paid in cash ($) | Common Stock ($) | Total Compensation ($) |

| Joshua Bershad, M.D. | 1,250 | 0 | 1,250 |

| James F. Cosgrove Jr. | 24,450 | 35,000 | 59,450 |

| Kim C. Hanemann | 18,950 | 35,000 | 53,950 |

| Steven M. Klein | 29,250 | 35,000 | 64,250 |

| Amy B. Mansue | 23,450 | 35,000 | 58,750 |

| Ann L. Noble | 20,250 | 35,000 | 55,250 |

| Walter G. Reinhard | 28,700 | 35,000 | 63,700 |

| Jeffries Shein | 6,700 | 35,000 | 41,700 |

*Until retirement in May 2020

As part of their annual compensation, each Director receives Company common stock valued at $35,000. The Board believes that all Directors should maintain a B.A.meaningful ownership stake in Economics from Rutgers University.the Company to underscore the importance of aligning their long-term interests with those of our shareholders. Directors are required to hold common stock valued at least three times the amount of the annual retainer by the fifth anniversary of Board membership. All Board members met this requirement for 2020.

*Reflects the minimum attendance of all Directors at Board and Committee meetings.

Middlesex Water Company 9 201810 2021 Proxy Statement

| » | All directors are independent, other than the CEO. |

| » | Independent Lead Director |

| » | Board committees are comprised entirely of independent directors |

| » | Commitment to corporate social responsibility and sustainability |

| » | Advisory vote on named executive officer compensation is held on an annual basis |

| » | Prohibitions against hedging and borrowing against Company stock |

| » | Stock ownership requirements for Directors and Executive Officers |

| » | Compensation Committee oversees alignment of pay to performance |

| » | Transparent process for shareholder communications with the Board |

| » | Annual Board and Committee evaluations |

Code of Ethics and Corporate Governance Guidelines

Management of the Company is under the general direction of the Board of Directors (the “Board”) who are elected by the shareholders. The Company’s business is managed under the direction of the Board in accordance with the New Jersey Business Corporation Act and our Certificate of Incorporation and By-laws. Members of the Board are kept apprised of our business through discussions with the Chairman and Chief Executive Officer and other Company Officers, by reviewing briefing materials and other relevant information provided to them, and by participating in meetings of the Board and its Committees.

The Board has adopted a Code of Conduct that applies to all Directors, Officers and employees. This Code encompasses all areas of professional conduct, as well as strict adherence to all laws and regulations applicable to the conduct of our business. In addition, the Company has established an internal hotlineEthics Hotline where Code of Conduct violations may be reported by any employee or member of the general public.

The Company’s Code of Conduct, as well as the charters for the Audit, Compensation, Corporate Governance & Nominating, and Pension Committees, are available on our websitewww.MiddlesexWater.comunderwebsite www.MiddlesexWater.com under the heading Investor Relations – (Corporate Governance)Investors - (Governance). We also make this information availablein print to any shareholder upon request. Requests should be addressed to Corporate Secretary, Middlesex Water Company, 1500 Ronson Road, P.O. Box 1500,485C Route 1 South, Suite 400, Iselin, New Jersey 08830-0452.

The Company’s Common Stock is listed on the Nasdaq Global Select Market. Nasdaq listing rules require that a majority of the Company’s directors be “Independent Directors” as defined by Nasdaq corporate governance standards. “Independent Director” means a person other than an Executive Officer or employee of the Company or any other individual having a relationship which, in the opinion of the Company’s Board of Directors, could interfere with the exercise of independent judgment in carrying out the responsibilities of a Director. For purposes of this rule, “Family Member” means a person’s spouse, parents, children and siblings, whether by blood, marriage or adoption, or anyone residing in such person’s home.

As defined by Nasdaq corporate governance requirements, a member of the Board is not independent if:

With the exception of Mr. Doll, who is an Executive Officer of the Company, the Board has determined that each member of the Board is independent under the Nasdaq listing standards.

The Board based this determination primarily on a review of the responses of the Directors to a comprehensive annual questionnaire regarding employment and compensation history, affiliations, family and other relationships, together with an examination of those companies with whom the Company transacts business. The Directors certify individually as to their representations.

The Board shall consist of not less than five nor more than twelve members in accordance with the By-laws.

Board Meetings and Annual Meeting

Attendance by Board Members

The frequency and length of Board meetings, as well as agenda items, are determined by the Chairman and Committee Chairs with input from all other Directors. Meeting schedules are approved by the full Board.

The Board holds regularly scheduled meetings and meets on other occasions when required. We expect our Directors to attend each meeting of the Board and of the committees on which he or she serves. We expect our Directors to attend our Annual Meeting of shareholders. During 2017, the Board held twelve meetings and the Board Committees held fifteen meetings. In 2017, no member of the Board attended fewer than 91% of the total number of meetings of the Board and Committees on which each served. All of the Directors serving at the time of the Annual Meeting of Shareholders held in May 2017 attended that meeting.

Middlesex Water Company 10 2018 Proxy Statement

The Board does not have a formal policy on whether or not the role of the Chief Executive Officer and Chairman of the Board should be separate or, if it is to be separate, whether the Chairman should be selected from the independent Directors or be an employee. Currently, the Company operates with one individual,Mr. Doll, serving as Chairman of the Board as well as President and Chief Executive Officer, coupled with a strong independent Lead Director and independent standing Board committees. The Board believes that combining the Chairman of the Board and President and Chief Executive Officer roles is the appropriate corporate governance structure at this time because: a) it most effectively utilizes Mr. Doll’s extensive utility and management experience and knowledge regarding the Company, and b) it leverages his capabilities in effectively identifying strategic priorities and leading discussions on, and execution of, the Company’s strategy.

The Board has embedded in its culture, a philosophy of “constructive tension” whereby, the Board fulfills its mission to support the strategic direction of the Company while simultaneously fully representing the interests of our shareholders. The Board accomplishes this by challenging the President and Chief Executive Officer and the Company’s management on an ongoing basis.

In order to ensure that the independent Directors play a leading role in our current leadership structure, the Board established the position ofmaintains a Lead Director in 2010 andposition. Mr. Walter Reinhard was named Lead Director at the May 2020 Board meeting replacing Jeffries Shein towho retired from the position. Mr. Shein, Director since 1990, serves on the Compensation, Corporate Governance & Nominating and Ad Hoc Pricing Committees.Board in May 2020.

Summary of Lead Director Responsibilities:

As part of our Board’s annual assessment process, the Board evaluates our Board leadership structure to ensure it remains appropriate. The Board recognizes there may be circumstances that would lead it to conclude that separate roles of Chief Executive Officer and Chairman of the Board may be appropriate, but believes that the absence of a formal policy requiring either the separation or combination of the roles of Chairman and Chief Executive Officer provides the flexibility to determine the most appropriate governance structure, as conditions potentially change in the future.

Middlesex Water Company 11 2021 Proxy Statement

The Board as a whole plays an integral role in shaping Middlesex Water’s strategy, governance and culture. Another critical responsibility is responsible for overseeing our risk exposure as part of determining business strategy that generates long-term shareholder value. Risk Management Oversight was formally added to the Corporate Governance Committee’s responsibilities in 2012 and remains under the supervisionoversight is a core responsibility of the Corporate Governance and Nominating Committee.

Specifically, the Corporate Governance and Nominating Committee is responsible for overseeing the process by which significant business and operational risks (including information security risks and risks related to climate change) are identified throughout the enterprise and the strategies developed to mitigate any identified risks. This added oversight is reflected in the Corporate Governance and Nominating Committee’s Charter which was recently revised and approved by the Board, and is available in the Investor RelationsInvestors section of our website www.MiddlesexWater.comwww.middlesexwater.com under Corporate Governance. The primary purpose of the Corporate Governance and Nominating Committee in fulfilling its risk management oversight responsibilities is accomplished by (i) assessing and reporting to the Board on the Company’s risk environment, including its material, strategic,and operational risks (including but not limited to the brand and reputation of the Company; the health and safety of the Company’s employees and the business operations of the enterprise); (ii) ensuring that management understands and accepts its responsibility for identifying, assessing, and managing risk; (iii) facilitating management’s strategic focus on the Company’s risk management vision and its evolution; (iv) verifying that the guidelines and policies governing the process by which risk assessment and management is undertaken are comprehensive and evolve commensurate with the risk profile of the Company;and (v) reviewing those risks that the Corporate Governance and Nominating Committee deems material to the Company’s shareholders. Management retains responsibility for all day-to-day activities of the Company, including administration of the Company’s formal Enterprise Risk Management program. The Corporate Governance and Nominating Committee updates the Board on risk management activities routinely throughout the year.

Specifically as it relates to cyber security, our Board receives regular updates from the Vice President of Information Technology on cyber risks and ongoing policies and plans to assess the effectiveness of our information technology and data security processes.

| Committee | Primary Areas of Risk Oversight |

| Audit | Risks Related to Financial Reporting and Controls Reviews work performed by the independent registered public accounting firm Supervises our independent and confidential Ethics hotline reporting system which encourages and allows employees to raise concerns Oversees matters related to internal audit functions Reviews and approves related party transactions, if any |

| Compensation | Oversees human capital risks Risks related to compensation and benefits program for executive management Risks related to organizational development including recruitment, retention and engagement |

| Corporate Governance and Nominating | Risks related to overall corporate governance, including our governance policies and practices Risks related to Board composition, Board structure and Board and executive officer succession planning Enterprise Risk management including operational, financial and brand risk Risks related to information technology and data security Risks related to corporate social responsibility and environmental, social and governance matters including climate related risks |

Middlesex Water Company 12 2021 Proxy Statement

Supporting Our People, Our Customers and Our Communities –

Middlesex Water credits its dedicated employees, business continuity and crisis management planning to ensuring uninterrupted service delivery during one of the most serious public health crises of our time. As we continue to navigate the COVID-19 pandemic, we remain focused on the delivery of water and wastewater services essential to everyday quality of life. We thank our frontline employees – those essential workers responsible for the day to day operation of treatment plants, those who ensured water quality compliance and crews responsible for responding to water service emergencies

These were some of the priorities that guided our Company’s response to COVID-19:

Middlesex Water Company 13 2021 Proxy Statement

The Company’s Common Stock is listed on the Nasdaq Global Select Market. Nasdaq listing rules require that a majority of the Company’s directors be “Independent Directors” as defined by Nasdaq corporate governance standards. “Independent Director” means a person other than an Executive Officer or employee of the Company or any other individual having a relationship which, in the opinion of the Company’s Board of Directors, could interfere with the exercise of independent judgment in carrying out the responsibilities of a Director. For purposes of this rule, “Family Member” means a person’s spouse, parents, children and siblings, whether by blood, marriage or adoption, or anyone residing in such person’s home.

As defined by Nasdaq corporate governance requirements, a member of the Board is not independent if the Director:

| ✔ | Is, or at any time during the past three years, has been employed by the Company. |

| ✔ | Has accepted, or has a family member that has accepted any compensation from the Company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the determination of independence. |

| ✔ | Is a family member of an individual who is, or at any time during the past three years was, employed by the Company as an Executive Officer. |

| ✔ | Is, or has a family member who is, a partner in, or a controlling Shareholder or an Executive Officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more. |

| ✔ | Is, or has a family member who is, employed as an Executive Officer of any other entity where at any time during the past three years any of the officers of the Company serve on the compensation committee of such other entity. |

| ✔ | Is, or has a family member who is, a current partner of the Company’s independent auditor, or was a partner or employee of the Company’s independent auditor who worked on the Company’s audit at any time during any of the past three years. |

With the exception of Mr. Doll, who is an Executive Officer of the Company, the Board has determined that each member of the Board is independent under the Nasdaq listing standards.

The Board based this determination primarily on a review of the responses of the Directors to a comprehensive annual questionnaire regarding employment and compensation history, affiliations, family and other relationships, together with an examination of those companies with whom the Company transacts business. The Directors certify individually as to their representations.

The Board shall consist of not less than five nor more than twelve members in accordance with the By-laws.

Board Meetings and Annual Meeting Attendance by Board Members

The frequency and length of Board meetings, as well as agenda items, are determined by the Chairman and Committee Chairs with input from all other Directors. Meeting schedules are approved by the full Board.

The Board holds regularly scheduled meetings and meets on other occasions when required. We expect our Directors to attend each meeting of the Board and of the committees on which they serve. We expect our Directors to attend our Annual Meeting of shareholders. During 2020, the Board held eight meetings and the Board Committees held thirteen meetings. In 2020, no member of the Board attended fewer than 81.3% of the total number of meetings of the Board and Committees on which each served. All of the Directors serving at the time of the Annual Meeting held in May 2020 attended that meeting.

The Independent Directors periodically meet without management in executive session. The Lead Director is designated to preside at these executive sessions.

Any shareholder wishing to communicate with a Director may do so by contacting the Company’s Corporate Secretary at 1500 Ronson Road, P.O. Box 1500, at:

Middlesex Water Company

485C Route 1 South, Suite 400,

Iselin, New Jersey 08830 who

The Corporate Secretary will forward to the Director a written, email or phone communication. The Corporate Secretary has been authorized by the Board to screen frivolous or unlawful communications or commercial advertisements.

In order to be eligible for inclusion in our proxy materials for our 20182021 Annual Meeting, any shareholder proposal must have been received by the Corporate Secretary of the Company, 1500 Ronson Road,485C Route 1 South, Suite 400, Iselin, New Jersey 08830 no later than December 11, 2017.9, 2020. No shareholder proposals were received by the Company for the 20182021 Annual Meeting.

Advanced Notice of Business to be Conducted at the Annual Meeting

Shareholders are entitled to submit proposals on matters appropriate for shareholder action consistent with regulations of the SEC. For business to be properly brought before an Annual Meeting by a shareholder, the business must be an appropriate matter to be voted by the shareholders at an Annual Meeting and the shareholder must have given proper and timely notice in writing to the Corporate Secretary of the Company at 1500 Ronson Road, P.O. Box 1500,485C Route 1 South, Suite 400, Iselin, New Jersey 08830-0452.

A shareholder’s notice to the Corporate Secretary must set forth as to each matter the shareholder proposes to bring before the Annual Meeting:

a) a brief description of the matter desired to be brought before the Annual Meeting and reasons for conducting such business at the Annual Meeting,

b) the name and address, as they appear in the Company’s records, of the shareholder proposing such business,

c) the class and number of shares of the Company which are beneficially owned by the shareholder and

d) any material interest of the shareholder in such business.

Middlesex Water Company 11 201814 2021 Proxy Statement

We welcome the opportunity to engage with our shareholders to share our perspectives on and obtain their feedback on matters of mutual interest. We engage with the shareholders throughout the year to:

How We Engage

We approach shareholder engagement as an integrated, year-round process involving the Chief Executive Officer, the Chief Financial Officer and our Investor Relations team. Throughout the year, we had dialogue with analysts, institutional investors, Proxy advisory firms, ESG Ratings Firms and others to inform and share our perspective and to solicit their feedback on our performance. This includes participation in virtual investor conferences, group and one-on-one meetings as well as our virtual annual shareholder meeting. We also share information in our Annual Report and Proxy Statement, press releases, SEC filings, quarterly shareholder letters, on our corporate and transfer agent website as well as in our Corporate Sustainability Report.

Key Themes Discussed in 2020

Risk Management: Managing operational risks including those related to emerging contaminants, cyber threats, climate change and human capital management is critical to business success.

Succession Planning: Recruitment and retention of qualified personnel to staff key leadership and technical positions is a top priority.

Environmental, Social and Governance: Enhanced disclosure on ESG related efforts that are improving the long term sustainability of the Company.

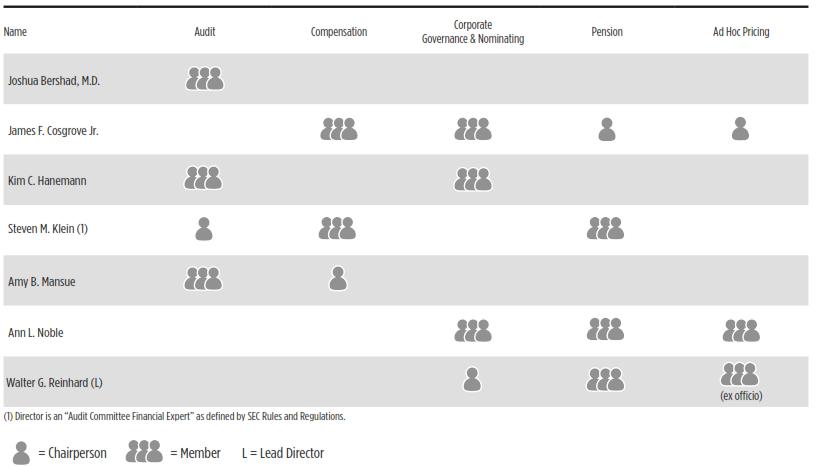

The Board maintains a number of standing committees to assist with the performance of its responsibilities. The number, structure and function of Board Committees are reviewed periodically by the Corporate Governance and Nominating Committee. The Committees regularly report to the Board on their deliberations. The Committees also bring to the Board for consideration those matters and decisions which the Committees judge to be of special significance and which require full Board approval. The table shown below provides information on currentboard committee membership.

membership for the year 2021.

Board and Committee Self-Evaluation

The Board periodically evaluates its performance through a self-assessment questionnaire which is reviewed by the Corporate Governance & Nominating Committee. The Board conducts such evaluations as determined by the Corporate Governance & Nominating Committee.

| Board Committee Membership | |||||

| Name | Audit | Compensation | Corporate Governance & Nominating | Pension | Ad Hoc Pricing |

| James F. Cosgrove, Jr. | Member | Chair | Chair | ||

| Kim C. Hanemann | Member | Member | |||

| Steven M. Klein (1) | Chair | Member | Member | ||

| Amy B. Mansue | Member | Chair | Member | ||

| John R. Middleton, M.D. (2) | Member | Member | Member | ||

| Walter G. Reinhard | Chair | Member | |||

| Jeffries Shein | Member | Member | Member | ||

| Total Committee Meetings | 7 | 3 | 4 | 4 | 0 |

(1) Director is an “Audit Committee Financial Expert: as defined by SEC Rules and Regulations.

(2) Dr. Middleton will retire from the Board of Directors effective May 22, 2018.

Middlesex Water Company 12 201815 2021 Proxy Statement

| Steven M. Klein, |

Audit Committee Members:

Kim C. Hanemann

Steven M. Klein

Amy B. Mansue

John R. Middleton, M.D.

Independent Members: 4

Meetings Held in 2017: 4

Audit Committee Responsibilities

The Audit Committee is responsible for oversight of the audit of the Company’s financial statements and internal controls over financial reporting. It is also assigned the responsibilities of (i) oversight of the Company’s internal audit functions; (ii) review of related party transactions with the Company; (iii) determining whether to grant waivers with respect to the Company’s Code of Conduct; and (iv) investigation of “whistleblower” complaints. In all its actions, the Committee shall comply with the requirements, rules and regulations of the Sarbanes-Oxley Act of 2002, Nasdaq Global Select Marketplace listing standards and all other applicable federal and state laws, rules and regulations.

In the course of performing its functions, the Audit Committee, as provided by the Audit Committee Charter:

The Board has determined that under current Nasdaq listing standards, all members of the Audit Committee are independent directors. The Audit Committee reports to the Board on its activities.

In March 2018, the Board of Directors re-approved the written Charter for the Audit Committee which is available in the Investor Relations section of our website www.MiddlesexWater.com under Corporate Governance. Please refer to this Charter for a full listing of Audit Committee responsibilities.

Audit Committee Members

Compensation Committee

Members:

Steven M. Klein

Amy B. Mansue

John R. Middleton, M.D.

Jeffries Shein

Independent Members: 4

Meetings Held in 2017: 3

Compensation Committee

Members in 2020:

James F. Cosgrove, Jr.

Steven M. Klein

Amy B. Mansue

Jeffries Shein*

Independent Members: 3

Meetings Held in 2020: 2

*Until his retirement in May 2020

Compensation Committee Responsibilities

The Compensation Committee has oversight of human capital risk and is focused on succession planning efforts at all levels of company management. The Committee is responsible for overseeing the development, implementation and effectiveness of the Company’s human capital management policies, programs, and initiatives and their alignment with the Company’s organizational needs. The Compensation Committee administers the compensation and benefits program for executive officers of the Company including the incentive compensation program for all participating employees.Company. In addition, the Committee administers the Compensation program relative to the Board in consultation with the Corporate Governance and Nominating Committee. In all its actions, the Committee shall comply with the requirements, rules and regulations of the Nasdaq Marketplace listing standards and all other applicable federal and state laws rules and regulations.

Two meetings were held in 2020, and executive sessions were held with the full Board, absent Mr. Doll, regarding compensation matters.

The Compensation Committee:

Independence

The Board has determined that under current Nasdaq listing standards, all members of the Compensation Committee are independent Directors. The Compensation Committee reports to the Board on its activities.

Committee Charter

In February 2018,2021, the Board of Directors re-approved a written Charter for the Compensation Committee which is available in the Investor RelationsInvestors section of our website www.MiddlesexWater.com under Corporate Governance. Please refer to this Charter for a full listing of Compensation Committee responsibilities.

Compensation Committee Interlocks and Insider Participation

The members of the 20172020 Compensation Committee were Steven M. Klein, Amy B. Mansue John R. Middleton, M.D. and Jeffries Shein.Shein until his retirement from the Board in May 2020. Mr. James F. Cosgrove, Jr. was added to the Compensation Committee in 2020. During 2017,2020, no member of the Compensation Committee was at any time an officer or employee of the Company or its subsidiaries. No current member is related to any other member of the Compensation Committee, any other member of the Board or any executive officer of the Company.

Middlesex Water Company 13 2018

Middlesex Water Company 16 2021 Proxy Statement

| Corporate Governance and Nominating Committee | Walter G. Reinhard, Corporate Governance and Nominating Committee Chair |

Corporate Governance and

Nominating Committee Members:

Members in 2020:

James F. Cosgrove Jr.

Amy B. Mansue

John R. Middleton, M.D.Kim C. Hanemann

Walter G. Reinhard

Jeffries SheinShein*

Independent Members: 54

Meetings Held in 2017:2020: 74

*Until his retirement in May 2020

Corporate Governance and Nominating Committee Responsibilities

The

The Corporate Governance and Nominating Committee shall provide assistance to the Board in fulfilling the responsibility for matters relating to the organization of the Board; shall identify, evaluate and propose new nominees to the Board; and make recommendation to the Board on all such matters and for other issues, including risk management oversight, relating to the Company’s corporate governance. In so doing, the Corporate Governance and Nominating Committee shall maintain free

and open means of communication between the Directors and executive officersExecutive Officers of the Company. In carrying out its responsibilities, the Corporate Governance and Nominating Committee strives to ensure to the Directors and shareholders that the corporate governance practices of the Company are in accordance with applicable laws and regulations and reflect the highest ethical standards.

Among its various responsibilities, the Corporate Governance and Nominating Committee:

• Reviews and makes recommendations relating to the performance of the Board, committee structures, risk management and the composition of the Board;

• Reviews and makes recommendations on matters related to Directors’ compensation;

• Reviews and makes recommendations related to any management proposals to make significant organizational changes to the Company;

• Seeks and identifies qualified candidates for Board membership and recommends to the Board candidates for nomination and election to the Board. In this capacity, the Committee focuses on the composition of the Board with respect to depth of experience, balance of professional interests, required expertise and other factors of diversity;

• Establishes and manages the process by which by which recommendations for Board membership are received and evaluated from shareholders and other sources;

• Reviews and makes recommendations to the Board with respect to succession planning.

• Oversees the Company’s efforts to implement, measure and report on Environmental, Social and Governance (ESG) related initiatives.

Independence

The Board has determined that under current Nasdaq listing standards, all members of the Corporate Governance and Nominating Committee are independent Directors Directors.

Committee Charter

A revised charter for the Corporate Governance and Nominating Committee was approved by the Board of Directors in November 2017,June 2020, and is available in the Investor RelationsInvestors section of our website www. MiddlesexWater.comwww.MiddlesexWater.com under Corporate Governance. Please refer to this Charter for a full listing of Corporate Governance and Nominating Committee responsibilities.

Process for Identifying and Evaluating Director Candidates

The Corporate Governance and Nominating Committee identifies Director nominees from a variety of sources which may include recommendations from management, Board members, shareholders and other sources.

The Committee recommends to the Board nominees that:

• are independent of management;

• satisfy SEC and Nasdaq requirements; and

• possess qualities such as personal and professional integrity, sound business judgment, utility expertise, technical, financial or other relevant expertise.